oregon statewide transit tax rate

Sales tax exemptions include clothing and footwear. Oregons unemployment rate was 55 in September 2016 while.

But why does Virginia have.

. The bills are due each year on Oct. The lowest non-zero state-level sales tax is in Colorado which has a. Qualifying Business Income Reduced Tax Rate For Oregon Full-year Residents Instructions.

The tax rate is 45 for transfers to direct. Form OR-40-V Oregon Individual Income Tax Payment Voucher. California has the highest state-level sales tax rate at 725 percent.

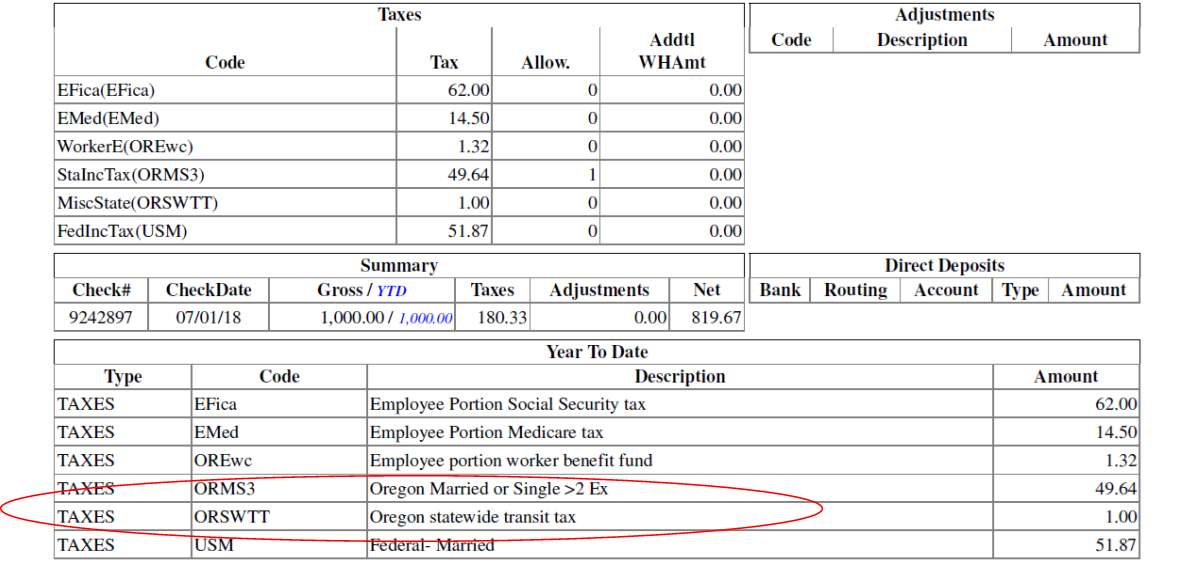

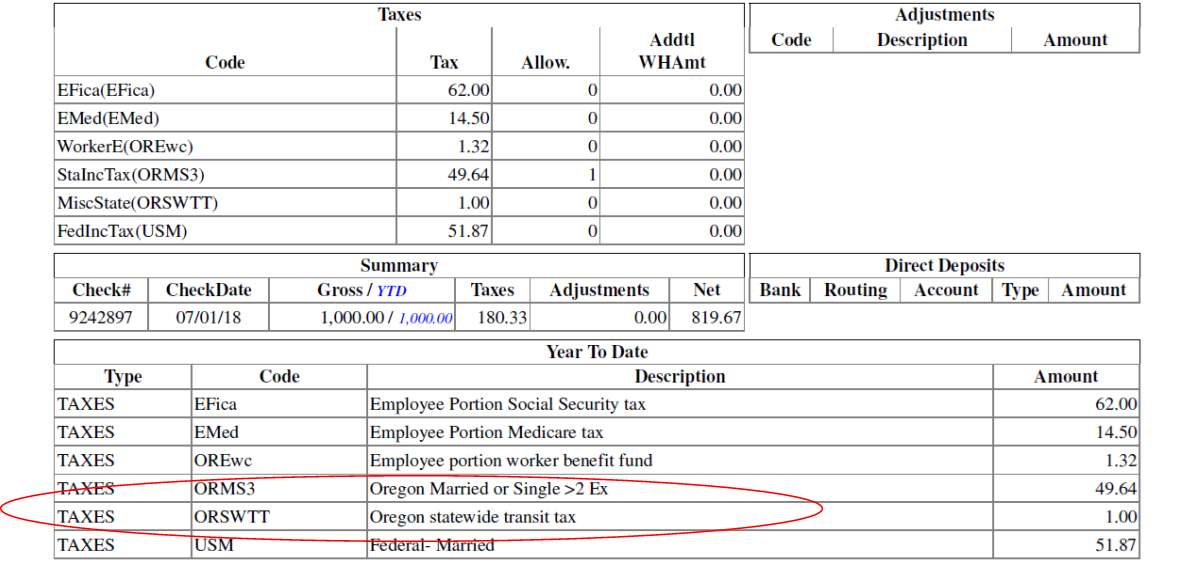

Some are levied directly from residents and others are levied indirectly. Indiana Mississippi Rhode Island and Tennessee. The Oregon Department of Revenue began assessing the tax July 1 2018.

Indiana Mississippi Rhode Island and Tennessee. The median property tax rate for Oregon homeowners is 1006 per. State tax levels indicate both the tax burden and the services a state can afford to provide residents.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. Four states tie for the second-highest statewide rate at 7 percent.

Form OR-STT-1 Oregon Quarterly Statewide Transit Tax Withholding Return. The other statewide officers are Treasurer Attorney General Superintendent and Labor Commissioner. This table includes the per capita tax collected at the state level.

The state income tax rate in Oregon is progressive and ranges from 475 to 99 while federal income tax rates range from 10 to 37 depending on your income. Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. Section 122 of House Bill 2017 provides statewide funding for public transportation service.

States use a different combination of sales income excise taxes and user fees. California has the highest state-level sales tax rate at 725 percent. The maximum local tax rate allowed by Ohio law is 225.

1 Notwithstanding ORS chapter 195 197 197A 215 227 or 468B or any statewide plan rule of the Land Conservation and Development Commission Environmental Quality Commission or local land use regulation zoning ordinance or comprehensive plan Lane County shall approve a planning application for the development of a permanent recreational. Texas has 2176 special sales tax jurisdictions with local. Rhode Island has a statewide tax of 7 so remote sellers do not need to calculate local rates.

Proceeds from the payroll tax will be deposited into the Statewide Transportation Improvement Fund. What is the income tax rate in Oregon. Sales tax in Rhode Island may be filed monthly or quarterly.

The lowest non-zero state-level sales tax is in Colorado which has a. And a transit tax that goes towards the Statewide Transportation Improvement Fund which helps cover public transportation related investments. The State of Oregon also allows transit district to levy an income tax on employers and the self-employed.

Ohio has a statewide sales tax rate of 575 which has been in place since 1934. But according to the Tax Foundation the statewide average is only 176. Threshold of 100000 in prior or current year.

Municipal governments in Ohio are also allowed to collect a local-option sales tax that ranges from 0 to 225 across the state with an average local tax of 1504 for a total of 7254 when combined with the state sales tax. 5 falls on a weekend or holiday. 5 or the following business day if Oct.

Four states tie for the second-highest statewide rate at 7 percent.

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Ezpaycheck How To Handle Oregon Statewide Transit Tax

What Is The Oregon Transit Tax How To File More

Or State Transit Tax Setup In Vista W 2s And Orsst W H Silvertrek Systems Knowledge Base

Oregon Transit Tax Procare Support

Oregon Transit Tax Procare Support

What Is The Oregon Transit Tax How To File More

New Transit Tax Cardinal Services

Oregon Transit Tax Procare Support

Ezpaycheck How To Handle Oregon Statewide Transit Tax